Kano Survey

The Kano Survey is a quantitative research tool aimed at discovering consumer expectations related to product functions and aspects of product quality. This type of survey can help choose between alternative options for a function, uncover hidden customer expectations about basic product functions and potential exciters, and help with prioritisation of product development work. It can also help to prevent over-engineering by identifying unnecessary features and improvements that would not contribute to customer satisfaction.

Kano survey questions and responses

The survey revolves around asking the same question from two opposite perspectives, then combining the answers to eliminate confused or arbitrary responses and discover true customer preferences.

For example, when researching whether some feature should be included in the product design, you can ask customers “How would you feel if this feature was present?” and “How would you feel if this feature did not exist?” When researching if you should improve some variable function, you can ask “How would you feel if this was faster?” and “How would you feel if this was slower?” When deciding between two mutually exclusive alternatives for a function, you can ask customers “How would you feel if this behaviour happened?” for both alternatives.

For each perspective, customers can choose one of the following options:

- like

- expect

- neutral

- can tolerate

- dislike

Kano surveys are particularly useful to help shape the understanding about customer needs and preferences according to the Kano Model. Once the faulty responses are eliminated, you can use the remaining answers to categorise the target of your research into segments of the Kano model. For example:

- If customers expect a feature to be present, and dislike when it’s not present, then it is basic

- If customers like when a feature is present, but dislike if it is not present, then it is a performance function

- If customers like when a feature is present, but are neutral if it not present, then it is an exciter

- If customers dislike when a feature is present, and expect it not to be present, then it is a dissatisfier

- Lack of strong opinion about both perspectives is likely signalling that the customer is indifferent

- Inconsistent responses (both positive, or both negative) suggest that the customer is not interested or not paying attention, and should be eliminated

Kano Survey Example

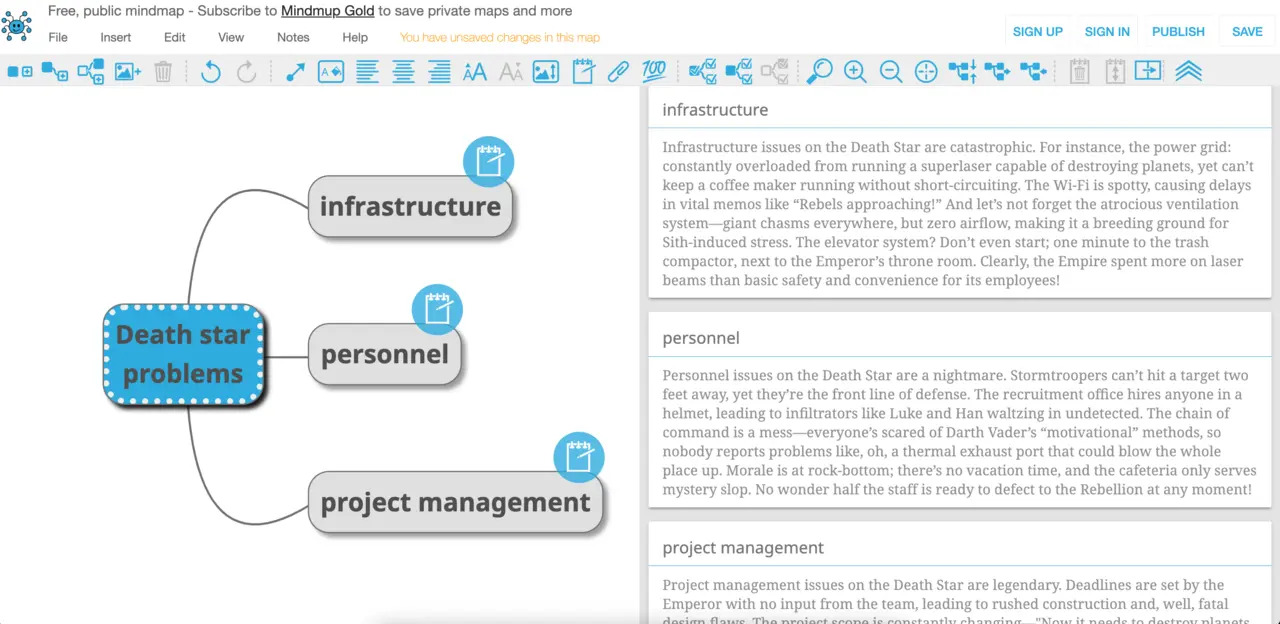

MindMup, an online mind mapping tool, conducted Kano surveys to research various development initiatives. For example, when introducing long-form text notes into mind maps, the team wanted to understand customer preferences around reordering and sorting notes. The initial research with a small group of power-users hinted that people would prefer allowing notes to show independently from the mind map, and to allow users to arrange them in arbitrary ways.

Using a mock-up of the user interface similar to the image above, the team engaged a large population of interested users asking how they would feel if they were able to rearrange and stack notes arbitrarily, and how they would feel if the order was fixed to reflect the sequence of nodes from the mind map. After compiling the results, the team decided not to implement any kind of reordering, significantly reducing the complexity for the notes feature. Most of the surveyed users were either indifferent or actively against independent reordering. The Kano Survey allowed the product managers to check the assumptions produced by the smaller open research, and ultimately prevent a pointless batch of work that would lead to overengineering.

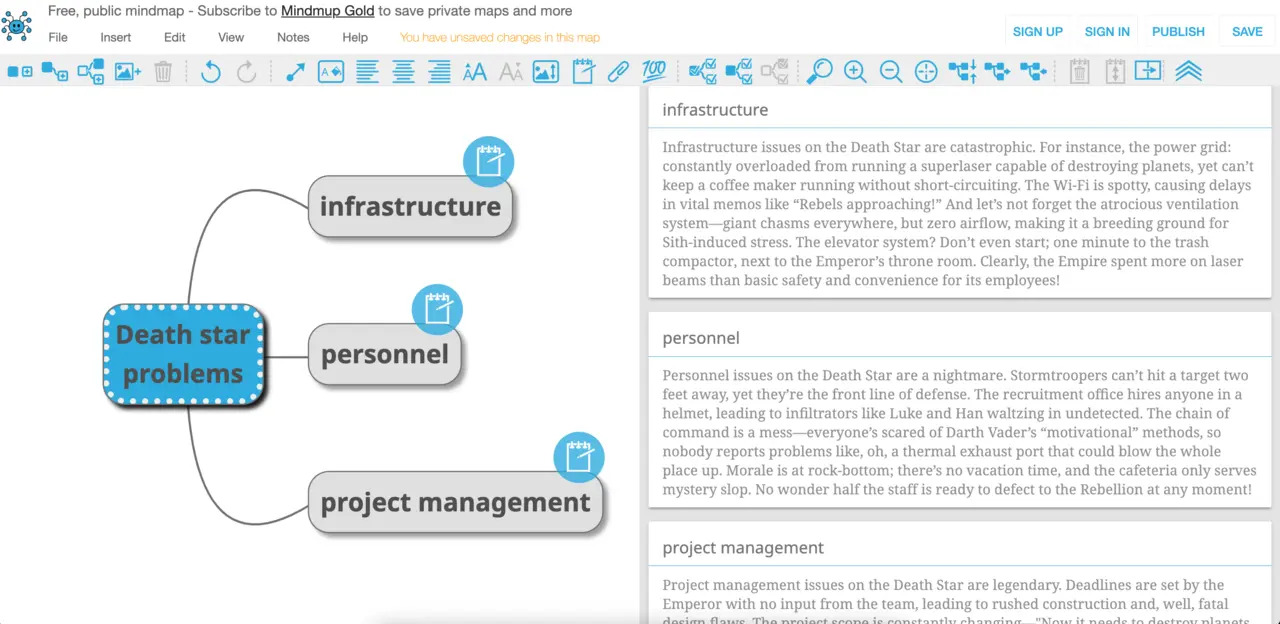

Similarly, the MindMup team used an Community Suggestion Forum to identify unmet user needs, deciding to add support for concept maps. Concept maps were visually similar to mind maps, but have several distinct features that were not easy to decide about. For example, when one concept on a map is related to two other concepts, there are two potential ways to visually show it, displayed in the image below:

The survey participants were asked to rate each option by selecting from the Kano survey answers, along with about a dozen similar questions for other aspects of concept maps. The survey revealed a strong expectation for the option on the left (this turned out to be a basic feature in the Kano model categorisation). The Kano survey helped to identify a viable release strategy, drive prioritisation and significantly focus delivery work required to launch concept mapping support.

Advantages of Kano surveys

Kano surveys can be used for systematic quantitative research with large populations of users. The questions and responses are closed (customers can only select from predetermined options) so the responses can be easily analysed at scale.

A big advantage of Kano surveys is that they are self-controlling. The combination of answers from two perspectives helps to eliminate inconsistent responses, where the surveyed participants were confused or not paying attention. It the participant understood the questions and had a strong opinion about the topic, they would be expected to provide a positive answer in one category and a negative in another. If, for example, someone said that they would like to be able to arbitrarily rearrange notes on a mind map, and that it would bother them if the notes did not follow the ordering from the map, then the response is invalid and should be removed from the survey results. Because of that, there is no need to include additional control questions and complicate the survey. Fewer questions generally leads to a higher completion rate, especially for longer surveys.

Downsides of Kano surveys

As a closed survey, the Kano questionnaire forces answers into discrete categories, which may not always accurately reflect the nuanced nature of customer satisfaction and expectations. This makes the model useful for later-stage research, once product managers already have a solid understanding of the user needs, and want to classify them further. For early stage research, other methods such as open-ended questions, focus groups, interviews or observing users will likely bring better results.

Another big limitation of this type of survey is the limited scope for innovation. The model focuses on current customer expectations and satisfaction, potentially overlooking innovative features that customers might not yet recognize as valuable.

Interpreting Kano survey results

Kano surveys can be scored and interpreted the same way Likert Scale surveys are interpreted.